Budget 2025: What it means for Social Care Providers’ Payroll

6 minute read

Social Care has been promised a Fair Pay Agreement (FPA) that finally recognises the value of the workforce.

But as Care England has warned, this Budget risks undermining the FPA before it even starts. Extending the freeze on Income Tax and National Insurance thresholds means care workers will keep less of any future pay rise, with providers expected to fund higher wages and more generous Statutory Sick Pay (SSP).

From where we sit – working with payroll data from providers across the UK – the message is clear: the cost of delivering good care is going up. The only real lever we have is how efficiently we manage our labour. So, this blog will focus on what the Budget means specifically for care providers’ payrolls, and how you can respond.

The key payroll changes at a glance

1. National Minimum Wage uplift (from April 2026)

- 21+ years: £12.71

- 18–20 years: £10.85

- Apprentices/16–17 years: £8.00

This rate only applies if an employee is under 19, or 19+ and in the first year of an apprenticeship. After that, they must be paid at least the minimum for their age group.

In care, where many staff sit at or near minimum wage, this lands straight on your payroll line.

2. More generous Statutory Sick Pay (from April 2026)

Three big changes:

- SSP from day one – no more three unpaid waiting days

- Lower Earnings Limit abolished – all employees qualify, no matter how little they earn

- New calculation – SSP is the lower of:

- 80% of average weekly earnings, or

- The flat rate (currently £118.75 per week for 2025/26)

- 80% of average weekly earnings, or

This improves protection for staff but increases the cost of every short-term absence – particularly in services with high sickness and burnout risk.

3. Tax and NI thresholds frozen to April 2031

Freezing thresholds for three more years means:

- More staff will be brought into higher tax/NI bands

- Care professionals see less of any pay rise in their take-home pay

4. Apprenticeships, pensions and other changes

A few other points worth noting:

- Apprenticeship funding for under-25s in SMEs will be fully funded – a real opportunity to build structured employee pipelines into care.

- From April 2029, a £2,000 NI-free cap on salary sacrifice pension contributions will apply; contributions above that will attract NI.

- From April 2028, an EV mileage tax (3p/mile for EVs, 1.5p/mile for hybrids) kicks in – relevant for community care teams.

- From April 2026, the homeworking expense deduction is abolished for employees (though employers can still reimburse directly).

- Student loan Plan 5 starts April 2026, and real-time payrolling of benefits (with P11Ds scrapped) becomes mandatory from April 2027, increasing payroll complexity.

Individually, some of these look small, but they all pull in the same direction: higher cost, more complexity.

What this actually looks like

Let’s keep it simple.

Imagine you employ:

- 500 frontline staff

- Each working an average of 35 hours a week

A 50p per hour pay rise alone adds roughly £455,000 a year in gross wages.

Add on:

- Employer NI

- Pension contributions

- Higher SSP usage under the new rules

- Agency cover when people are off sick

…and that number climbs quickly.

At Sona, our payroll team is using anonymised payroll data from across our Care customers to model these impacts. For each provider, we can estimate:

- Additional annual payroll cost from the 2026 minimum wage and SSP changes

- How that cost breaks down by site, role, and contract type

- The level of labour savings you’d need (less agency, better scheduling, fewer errors) to offset it, to find out more book a call with a member of our team.

The wider picture for Social Care

Professor Martin Green OBE, summed up the wider challenge:

- Providers are absorbing rising wages, higher operational costs and growing complexity of care

- Councils are in severe financial difficulty, limiting room for higher fee rates

- New tax and council tax measures risk destabilising services if care homes aren’t explicitly considered

However there are also positives - fully funded apprenticeships for SMEs, and changes to welfare that will help many low-paid families in social care. But those measures don’t automatically translate into sustainable contracts.

The gap between what good pay and conditions should look like and what’s funded is growing. That’s where payroll and workforce data become strategic tools, not just back-office admin.

Where providers do have control

You can’t change the Budget. You can change how you respond to it.

Here’s where the most forward-thinking providers are focusing:

- Scenario modelling

Use real payroll data to model NLW uplifts, SSP changes and potential FPA outcomes. Identify which services, roles or regions will come under the most pressure, and plan early. - Managing sickness and SSP exposure

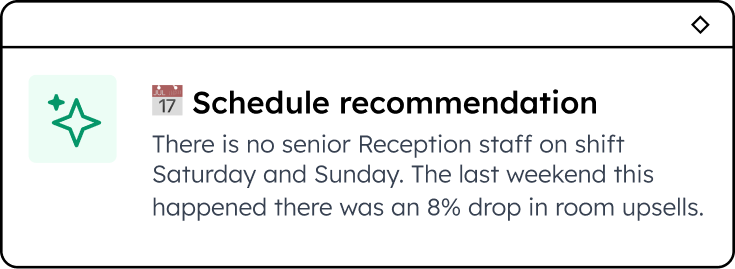

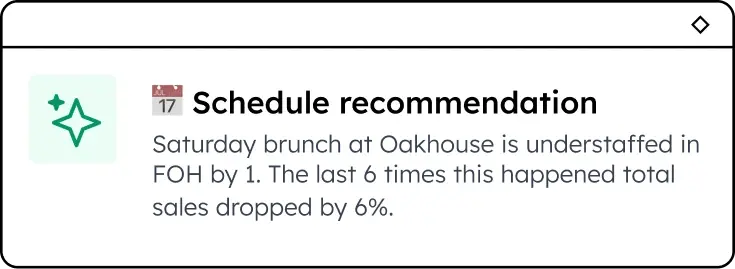

Better visibility of absence patterns (by team, site, or shift) helps you intervene earlier, support staff better and reduce unnecessary sick days – which matters more now SSP starts from day one for everyone. - Smarter scheduling

Matching contracted hours to commissioned care and reducing reliance on last-minute agency is one of the most effective ways to create headroom for higher wages. - Making the most of apprenticeships

With under-25 apprenticeships fully funded for SMEs, there’s an opportunity to design progression paths that improve retention without simply inflating your average hourly rate overnight.

How Sona can help

Sona was built around the challenges you’re facing now: regulated services, tight margins, and a workforce that deserves better.

For Social Care providers, that means:

- Scheduling and payroll that work together

Complex shifts, premiums, sleep-ins, allowances – all handled in one system that feeds cleanly into payroll. Fewer manual adjustments, fewer errors, less admin. - Real-time labour cost visibility

Dashboards that show overtime, agency usage, contracted vs delivered hours and SSP exposure as they happen, not weeks after payroll has run. - Data-driven cost modelling

Our care payroll team uses anonymised data from thousands of care professionals on Sona to:

- Estimate the additional payroll cost of the Budget changes for your organisation

- Run “what if” scenarios (e.g. sickness up 10%, agency down 20%)

- Quantify how much efficiency gain you need to stay sustainable

- Estimate the additional payroll cost of the Budget changes for your organisation

- Proven impact in social care

Providers using Sona have: - Saved 1.5% of their £90m payroll in the first 4 months (Salutem Care & Education)

- Saved over £1m in this financial year by matching care delivery to demand (Liaise)

- Cut agency spend from £200k to less than 10k (Perthyn)

- Reduced manual HR and payroll admin by up to 8 hrs per week (Salutem Care & Education)

In an environment of frozen thresholds, higher minimum pay, and more generous SSP, even a 1–2% improvement in labour efficiency can be the difference between a service that’s constantly firefighting and one that has room to grow.

If you’d like to understand what these changes mean for your organisation, our team would be happy to walk you through it, get in touch today.

Enjoyed this article? Let's stay in touch 👋

If you liked this article, why not subscribe to our newsletter to get the latest news and views delivered straight to your inbox?